Markets entered 2025 with high expectations for a business-friendly environment, anticipating tax cuts and deregulation from the Trump administration. The Standard and Poor’s 500 stock index reached an all-time high in January. However, the administration’s actions quickly shifted the landscape. The newly established Department of Government Efficiency (DOGE) began indiscriminately cutting federal government workers, shuttering agencies like USAID, and slashing government budgets. This was followed by the imposition of 25% tariffs on Mexico and Canada and a 20% tariff surcharge on China. The administration then announced April 2nd as “Liberation Day,” when reciprocal tariffs would be applied to all countries.

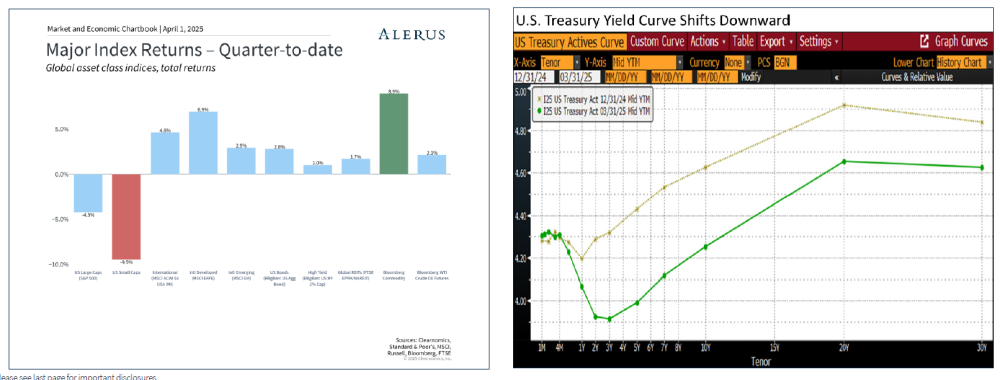

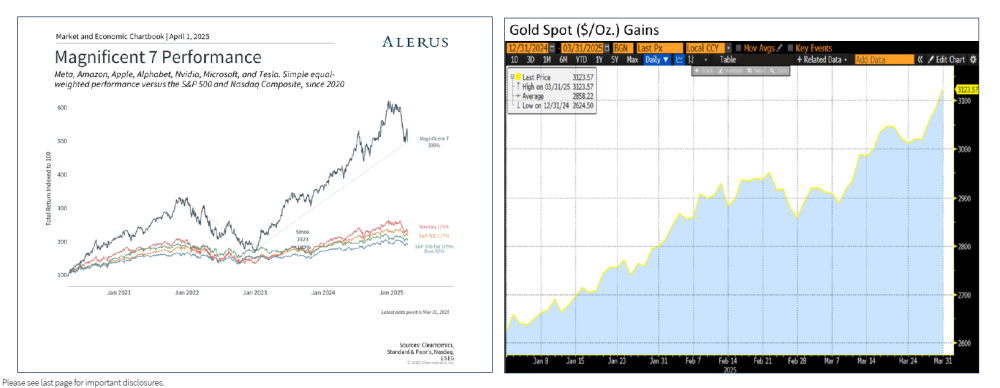

The constant flux of government cuts, tariff headlines, judicial rulings, and weakening consumer sentiment hammered equity markets into corrective territory and sent long Treasury bond yields tumbling. The dollar fell almost 3% in the first quarter as investors fled U.S. assets in to avoid policy uncertainty and slowing economic growth. This helped European stocks outperform domestic equities, bolstered by Germany’s announcement to increase its defense budget. Fiscal stimulus measures to boost domestic spending and the release of DeepSeek drove Chinese stocks higher. However, the best-performing asset class this quarter was gold, driven by policy uncertainty and the potential for stagflation in the U.S. due to high levels of reciprocal tariffs on all countries especially China.

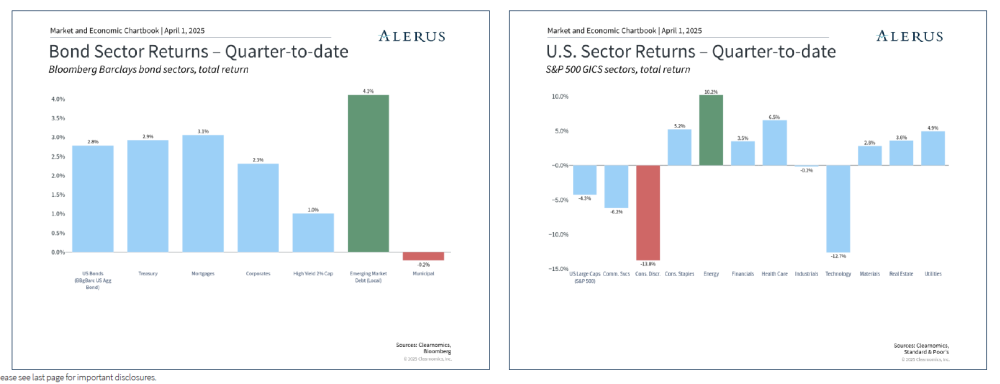

Tariff headlines dominated the first quarter, with significant levies announced against U.S. trading partners by the new administration within weeks of taking office. However, the administration’s constant changes and lack of clarity increased economic uncertainty and drove yields lower. A decline in yields across the entire yield curve benefited bonds, producing strong positive performance. The yield on the 10-year Treasury note declined by 37 basis points, similar to the two-year Treasury, which kept the yield curve slope unchanged. The Bloomberg U.S. Aggregate Bond Index returned 2.8% for the quarter.

Inflation running above the Federal Reserve (Fed) Fed’s target of 2%, along with a resilient labor market, kept the Fed on the sidelines, holding policy rates steady at 4.25% – 4.50%. Tariffs are expected to add to inflationary pressure in the near term, making it challenging for the Fed to cut rates should the economy slow down. However, financial markets are looking through the temporary increase in prices and focusing more on the slowing economy pricing in three rate cuts by the end of 2025.

Corporate bonds underperformed government securities as spreads widened in anticipation of a slowing economy. Investment-grade corporate bonds returned 2.3% for the quarter as spreads widened by +14 basis points amid heavy issuances. The ending spread levels of 89 basis points remain well below long-run averages. High yield bonds returned 1.0% for the quarter. Risker segments of the credit market were more affected by the shifting economic backdrop.

Within fixed income, agency-backed mortgages were the best performing sector, returning 3.1% for the quarter as investors fled to the safety of government debt that offered spreads similar or higher than corporate bonds. Municipal bonds declined 0.2% for the quarter. March is generally a tough month for the municipal debt market, with higher supply combined with fewer bonds maturing, reducing reinvestment opportunities. Additionally, some investors sell their holdings to pay their tax bills in April, adding to the pressure.

The Standard and Poor’s 500 stock index fell 4.3% in the first quarter, weighed down by tariff uncertainty and a burgeoning global trade war, which likely increased domestic prices of imported goods and slowed global economic growth. Economists believe that personnel and budget cuts by the DOGE and over a 90% reduction in the flow of undocumented immigrants into the U.S. would also contribute to the domestic slow down.

Negative investor sentiment helped defensive sectors such as energy, healthcare, and consumer staples lead performance in the first quarter. Surprisingly, energy was the best-performing sector, up roughly 10%, despite oil prices rising only 2%. Investors viewed large integrated oil companies such as ExxonMobil and Chevron as “safe havens” due to their cashflow generation and ability to weather downturns. News that China’s DeepSeek had developed an artificial intelligence (AI) model comparable to market leaders, but at a fraction of the cost, caused investors to reassess expectations around AI, pressuring large technology stocks, which had led the market since 2022. A combination of the DeepSeek revelation and tariff uncertainty hurt the “magnificent 7” large technology stocks which had led the market since it bottomed in October 2022. Those seven stocks declined 14% in the first quarter. The consumer discretionary sector was also hit hard, bearing the highest impact of tariffs on Asian countries such as China, Vietnam, and Cambodia. Small caps and growth stocks underperformed large companies and value stocks as investor sentiment turned risk-off.

International markets outperformed the domestic stock market in the first quarter. Some of this was a reversal from last year when investors bought dollar assets in anticipation of and following a Trump victory. The Chinese stock market was supported by government stimulus to prop up its consumer sector, while European stocks rallied in response to increased defense spending due to President Trump’s reduced support for the war in Ukraine. Emerging markets were also up in the first quarter, despite tariff uncertainty, as the dollar weakened and U.S. Treasury bond yields fell. Some emerging European markets, including Poland, Greece, the Czech Republic, and Hungary posted particularly strong returns, supported by an improved outlook for the Eurozone.

Gold prices surged 19% in the first quarter, reaching an all-time high of $3,112.80 per troy ounce. Amidst tariff uncertainty, falling stock prices, and declining yields, investors turned to gold as a safe haven. With tariffs likely to cause stagflation in the U.S., at least temporarily, gold often outperforms other asset classes. It also serves as a hedge against higher inflation, which is expected to rise once the tariffs take effect.

The substance, severity, and sequencing of President Trump’s policies – high tariffs, an aggressive deportation agenda, and substantial personnel and budget cuts – are likely to act as significant headwinds to equity and fixed income markets if there are no offsetting policies. We believe hefty tariffs imposed by the Trump administration are substantially increasing prices of imported goods, causing higher inflation in the near-term but acting as a tax in the long-term, slowing economic growth. Additionally, policies such as limiting the inflow and deporting immigrants, firing federal government employees, and slashing budgets should add to the slowdown, potentially leading to an economic recession. While the labor market remains resilient today, it is unlikely to remain so in the face of slowing growth pressuring consumer spending.

Under these conditions, we would have anticipated the Fed to step in and cut interest rates to support the economy. However, with tariffs anticipated to pressure prices higher in the near term, we anticipate the Fed to wait until growth slows and the labor market deteriorates before taking any action. The administration does have a pro-growth agenda which includes deregulation and tax cuts, but these are unlikely to impact the economy until later this year or in 2026.

We believe government-backed mortgages are attractive and are overweight in this sector. The sector has wider-than-average spreads, no credit risk, and limited issuance given high rates and low refinance activity. Low demand from banks and the Fed, historically two of the largest mortgage holders, has pushed spreads wider. We believe the spread widening presents an attractive opportunity for investors. Our mortgage overweight is funded by an underweight to the U.S. Treasury sector. We are neutral investment grade corporates and underweight high yield. Shortly after quarter ended, we reduced our high yield exposure from 4% to 2% and shifted the allocation to 7–10-year U.S. Treasury bonds. Credit spreads remain tight by historical measures and reflect little risk of any kind of credit market stress. This suggests there is room for spreads to widen amid policy uncertainty and slowing growth. We will continue to adjust our strategy and may further decrease our credit exposure and increase our U.S. Treasury weighting if there isn’t a positive resolution to tariff policy. We anticipate the favorable backdrop of the municipal sector to continue in 2025, driven by attractive yields on a tax-equivalent basis.

As we enter the second quarter of 2025, equity markets are navigating a complex landscape characterized by evolving trade policy, shifting economic data, and sector-specific dynamics. The Fed’s pivot to a more accommodative stance that began in late 2024 continues to provide support for equities broadly but has been muddied with the introduction of tariffs. The market anticipates further monetary easing, though the pace remains dependent upon data and the tariff picture. While this environment has historically been favorable for equities, particularly growth-oriented sectors, it is subject to change very rapidly. Economic indicators also present a mixed picture, with resilient consumer spending counterbalanced by signs of softening in certain manufacturing segments. Corporate earnings have generally exceeded expectations, though margin pressures are becoming more evident across various industries as companies navigate tariffs, labor costs, and supply chain recalibrations.

Considering the unsettled nature of the current administration’s plans, an overall market view is difficult to articulate. However, we anticipate certain sectors such as healthcare and utilities to outperform should tariff outcomes that cause slowing economic growth and potentially a recession. However, if the administration were to reverse course we would anticipate sectors such as consumer discretionary and technology to outperform. Given the many potential economic outcomes, such as stagflation, hard-landing, or a more balanced trade and fiscal profile, we still prefer large-cap companies over smaller companies. With heightened policy uncertainty in the U.S., it is likely investors will seek better opportunities abroad especially in international equities.

In this uncertain environment with the potential for stagflation, we anticipate gold to continue to perform well.